Iterata Finance Platform

Education Events

Introduction

Thesis

Determining the need for credit → When it comes to financing educational events (schools, studies, training & further education, etc.) and many other life events, the average citizen shies away from taking out a loan. The demand for credit has only become established in the areas of financing cars and real estate. For these reasons there in the colloquial language also not from credit need one speaks but from mortgages and/or leasing.

Conclusion

The Swiss citizen has a huge inhibition to make a credit request for other events than the two mentioned above. There are also concrete financing demands in the field of education, but these must be marketed differently for psychological reasons.

Status Quo

Due to the reorganization of the school system, the question arises for many families and single parents:

Should my child attend a so-called "normal school" (quality, lack of day care, classes too large, no targeted support, problem children, etc.)? As an alternative, there were and are various private schools, which are constantly growing.

Reasons for private school in the past

- Different school (designed according to special ideologies, Steiner schools, Christian schools, etc.)

- Pupil cannot exist in public school (Intellectual reasons, Social reasons)

New main reason (demand)

- Offer of comprehensive day structures so that the mother's gainful employment is made possible.

- !!! How to address the women !!!

Possible trends

- Private schools are expanding their share of the school market

- Larger companies offer day care schools

- Clarification of interest, development of internal own school

- Survey by means of internal survey

Educational events

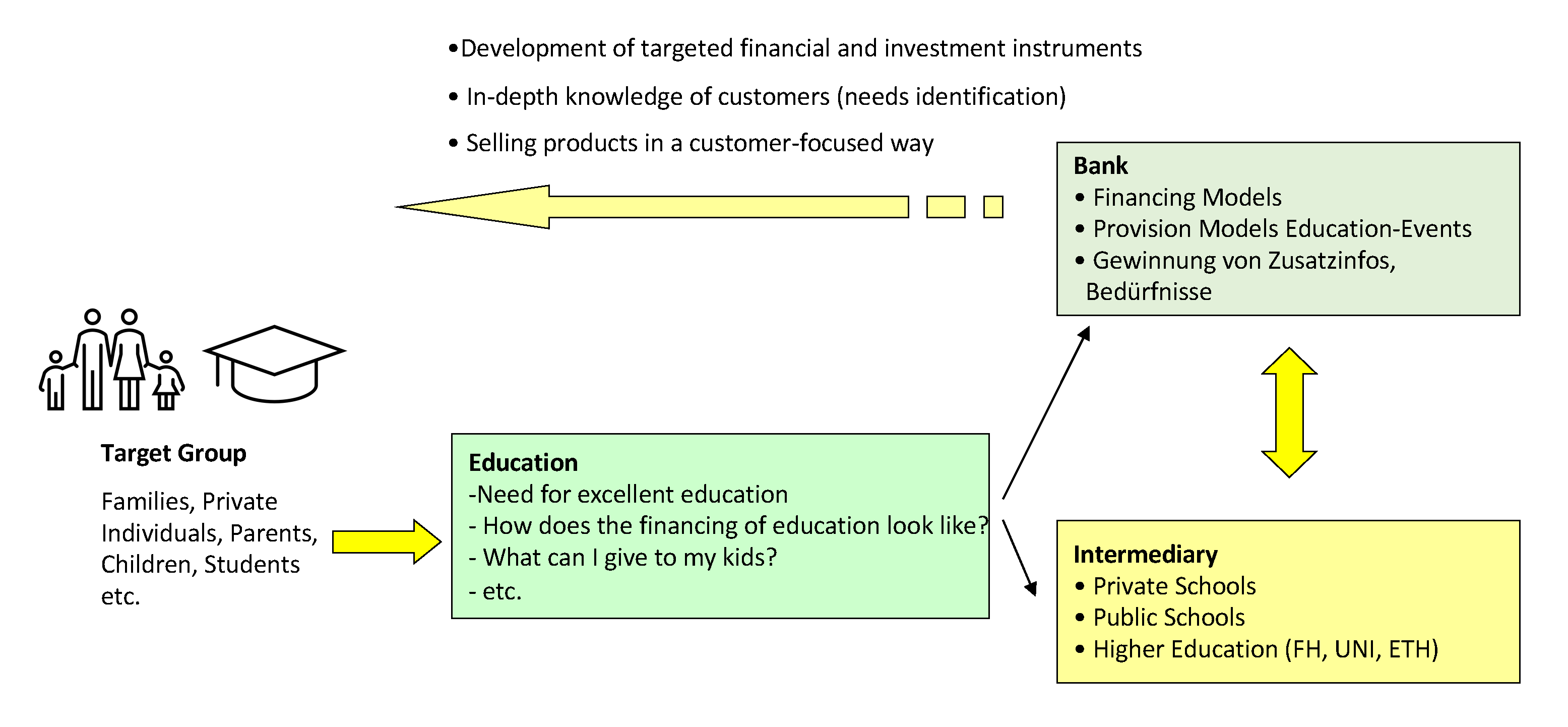

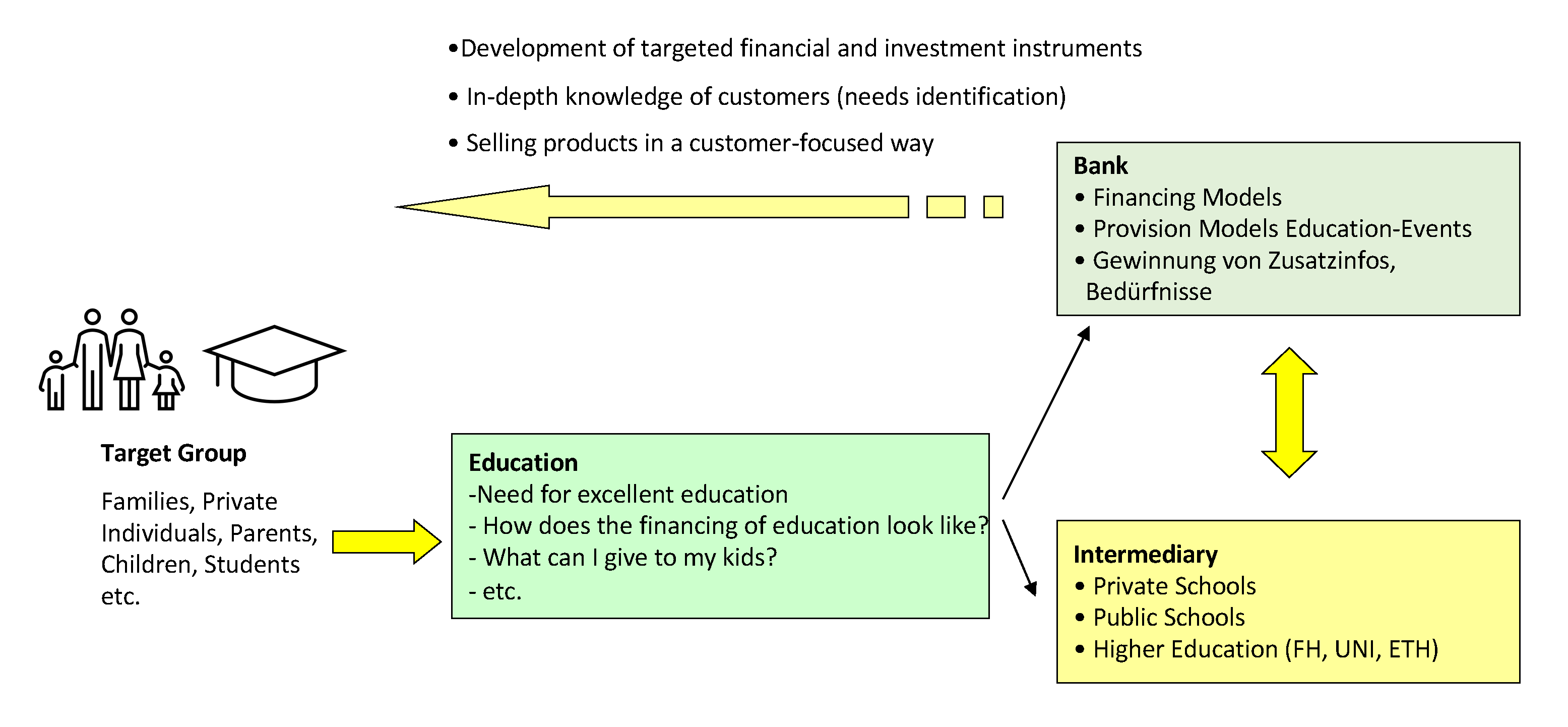

The issue described above raises the question of how such educational events can be financed. In this context, financing options are increasingly in demand from parents and schools.

On the one hand, private, public and university institutions can be used as intermediaries to attract entire families as new customers for the bank in the future. In addition to the early acquisition of children, sales potential can also be identified in other areas of banking.

Products and targeted financing models

By offering targeted products (not pure credit products), it is thus possible to obtain some information about a customer in the savings phases, such as savings capacity, savings activity, risk capacity, etc. The bank can then use this information to develop new products and financing models. From these customer insights, the bank can develop and offer new products.

Concept

Support process

In the care process, the following requirements arise from parents to a private school. A key point is the all-day care of the children. Especially for single parents and working parents it is important that they can drop off their children before work and pick them up again after work. Schoolwork is done during normal childcare hours, this opens up stress-free work time for parents and they don't have to constantly worry about what if classes are cancelled and hours are postponed. Full day care can be used as the main economic argument.

Example: Parent earns 30 Fr. per hour and the expenses for a child in care would amount to approximately 9 Fr. per hour.

Loss of hours → Stress for parent (flexibility).

Vacations → Not 12 weeks, camps & theme weeks

Vacation arrangement with parents, when it suits the parents

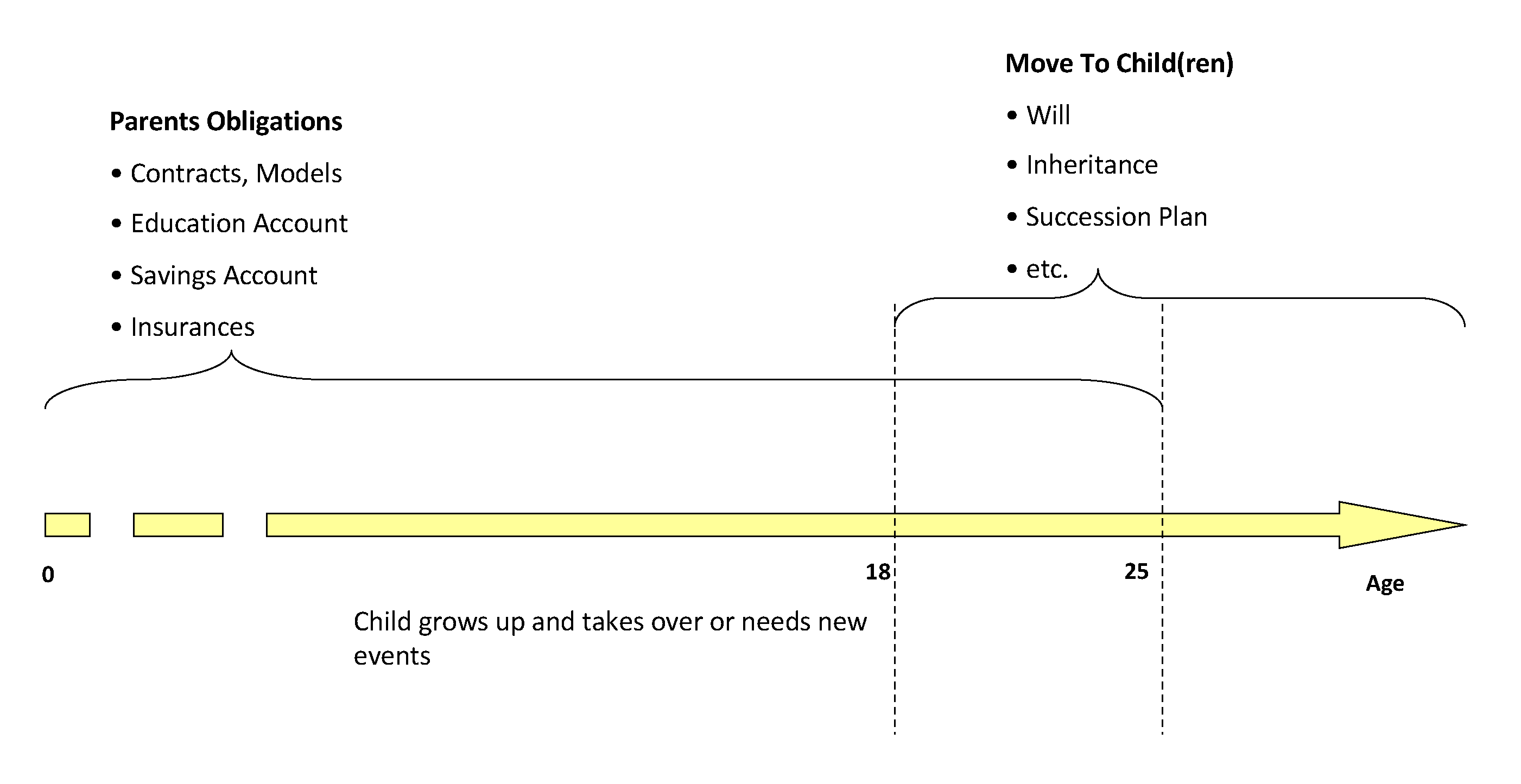

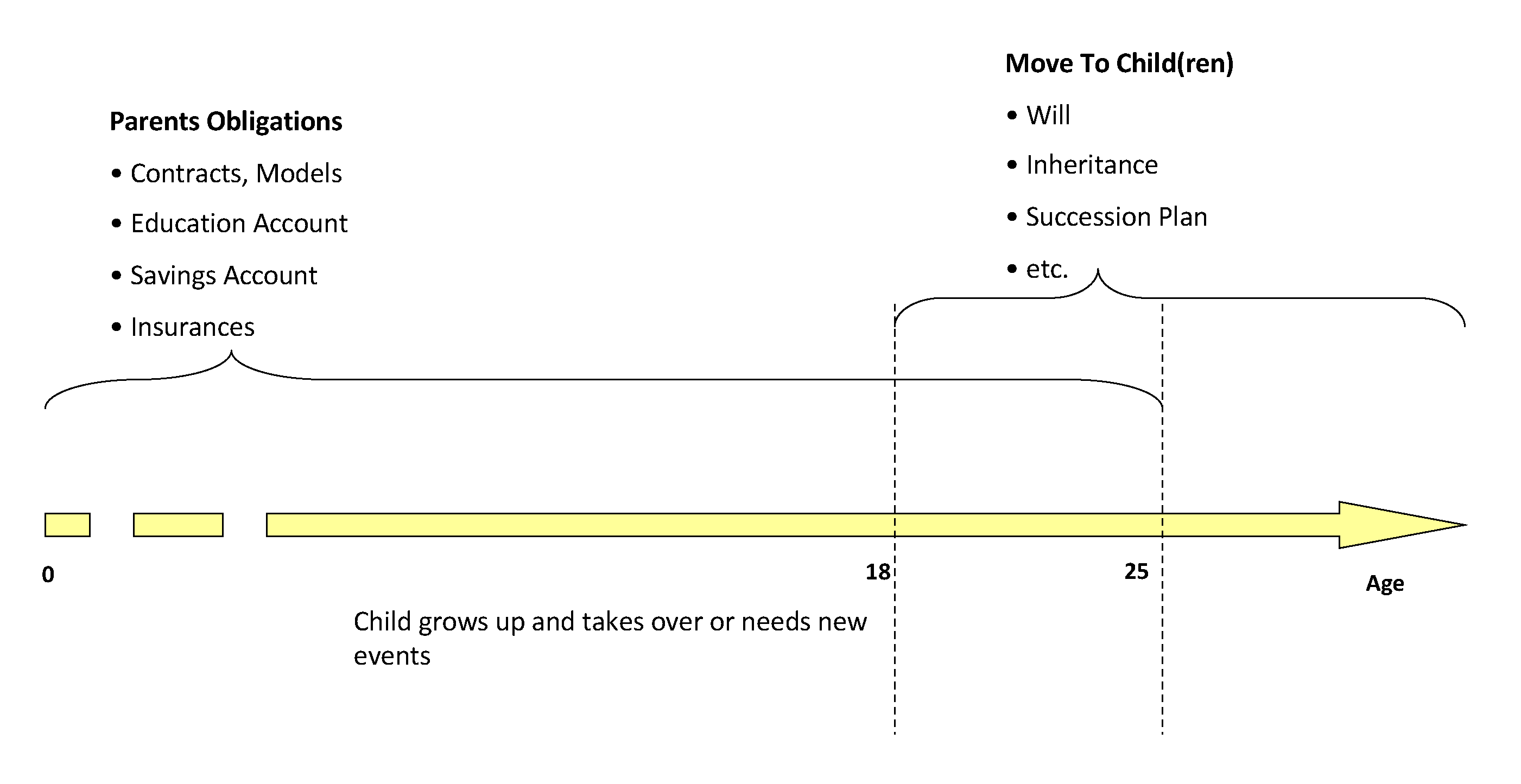

Lifecycle cycle

The commitment phase of the parents extends from the child's birth to his or her 25th birthday. In this first phase, it is the parents who open products up to the child's 18th birthday (signing authority). From the age of 18, things will change as the child comes of age. From then on, it would be enormously important for the bank to already have the offspring with it. Here, educational events could be used to make the connection to descendant regulations, wills and inheritance areas.

Goals

- Greater ability to plan financial requirements (funds required for loans)

- Free design of costs, interest rates, models

- Financing model for education and training

- Attraction of families and children at an early stage

- Strengthening of information offer

- Creation of additional opportunities

- Contact on an emotional level

- Bank as service provider for educational events (no financial pressure on parents)

- Is not perceived as a loan (financing opportunity, worthwhile investment for the future)

- Saving-Consumption-Clearing